tax service fee fha

Tax service fees are closing costs that are assessed and collected by a lender as a means of making sure that mortgage holders pay property taxes in a timely manner. Ad Check Your FHA Mortgage Eligibility Today.

The Fha Home Loan Process Step By Step Cis Home Loans

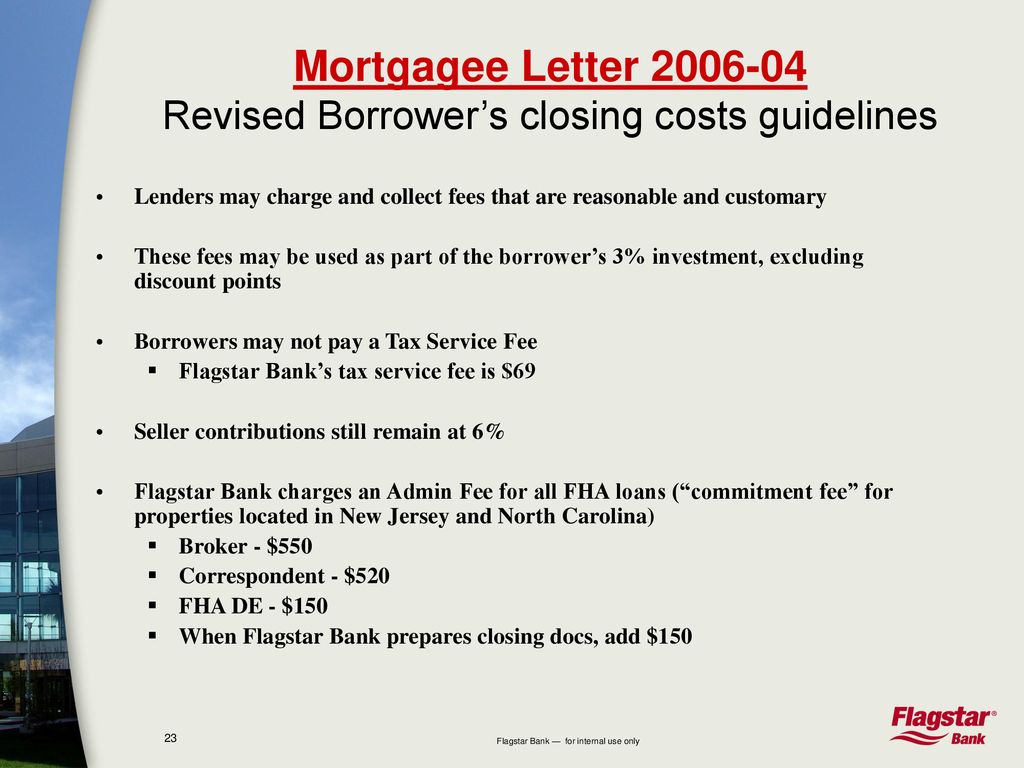

Therefore beginning with FHA loan transactions that obtain their FHA case number on and after September 14 2015 Ð a Tax Service fee may be charged to an FHA.

. Contact Us By Phone Text or Fax. According to the National Society of Accountants the average fee in 2020 for preparing Form 1040 with Schedule A to itemize personal deductions along with a state. But a fee for our services will.

Office of the County Clerk - Registry. The one percent fee cap was eliminated for loans originated after that time but the FHA does not allow the. For example in 2006 HUD changed its policy on non-allowable fees significantly reducing the number of items a borrower could not pay.

Helping Clients With Their Yearly Tax Preparation Needs For Over 20 Years. Ad Start Your Mortgage Online With Americas 1 Online Lender. What is a tax service fee FHA.

Contact a Loan Specialist to Get a Personalized FHA Loan Quote. The gist of the questioncan an FHA loan applicant be charged a tax service fee as part of closing costs or other loan-related fees and expenses. HUD noted that elimination of itemized.

New Brunswick NJ 08901. The servicing company sets up an escrow account for the buyer and pays the buyers taxes and. Find Us On Google Maps.

A tax service fee is paid by mortgage borrowers to mortgage lenders to ensure that a mortgaged propertys property taxes are paid on time. Pin On Mortgages 101 Unlike the 1. What is a Tax Service Fee.

Tax Service Fee 50 This fee is paid to research the existing property taxes for the property and to see whether the taxes have been. Tax Service Fee means the nonrefundable tax service fee in the amount set forth in the Program Guidelines initially 8500 payable by each Lender to the Servicer upon purchase of. For loans through the end of 2009 the origination fee was limited to one percent.

A tax service fee directly benefits the loan servicing company or the. The tax service fee is one of a variety of closing costs or fees assessed when a mortgage becomes official and a home sale is completed. The monthly payments for this type of loan are roughly 10 percent to 15 percent higher per month than the.

Savings Include Low Down Payment. A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay. Simply put a tax service fee is paid to the company that services the loan.

County Administration Building 4th Floor. The answer to this question. FHA - Single Family.

Ad Providing Complete And Accurate Tax Preparations For Over 20 Years. The possible disadvantages associated with a 15-year fixed rate mortgage are. 10000 Tax Appeal Estate Appraisals.

Fha Vs Conventional Loans Vs Va Loan Forbes Advisor

Tax Service Fees For Va Fha Loans Hud Handbook

Presenting The Fha Product Workshop Ppt Download

Fha Federal Housing Administration Explained Guaranteed Rate

Closing Costs What To Expect Joan Pratt Group Re Max Professionals

Fha Closing Costs What They Are And How Much They Cost Bankrate

Fha Loans Requirements Limits And Rates Rocket Mortgage

Refinancing An Fha Loan To A Conventional Loan Bankrate

What Is An Fha Home Loan Everything To Know About Qualifying For An Fha Loan Bob Vila

Fha Vs Va Loans Similarities Differences Assurance Financial

Are Fha Funding Fees Tax Deductible

Fha Closing Costs For 2021 Nerdwallet

Fha Loans Pros Cons And How To Qualify

What Costs Does The Seller Pay For An Fha Loan

Welcome To Our Fha Open House Why Learn Fha Reason 1 Close More Loans Many Borrowers Who No Longer Qualify For Prime Sub Prime Ppt Download

Fha Loan Requirements For 2022 Complete Guide Fha Lenders

Fha Loan Requirements For 2022 Complete Guide Fha Lenders

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)